Part of the fun of annual tax compliance is pulling together all the payments made throughout the year to determine who gets Form-1099. For small businesses with independent contractors, get ready for the new Form 1099-NEC replacing the 1099-MISC.

The form isn’t new. The IRS dusted off its playbook and brought back Form 1099-NEC for Nonemployee Compensation to simplify due dates associated with Form 1099-MISC.

So which form do you need to file in 2020? The answer depends on the nature of your payments.

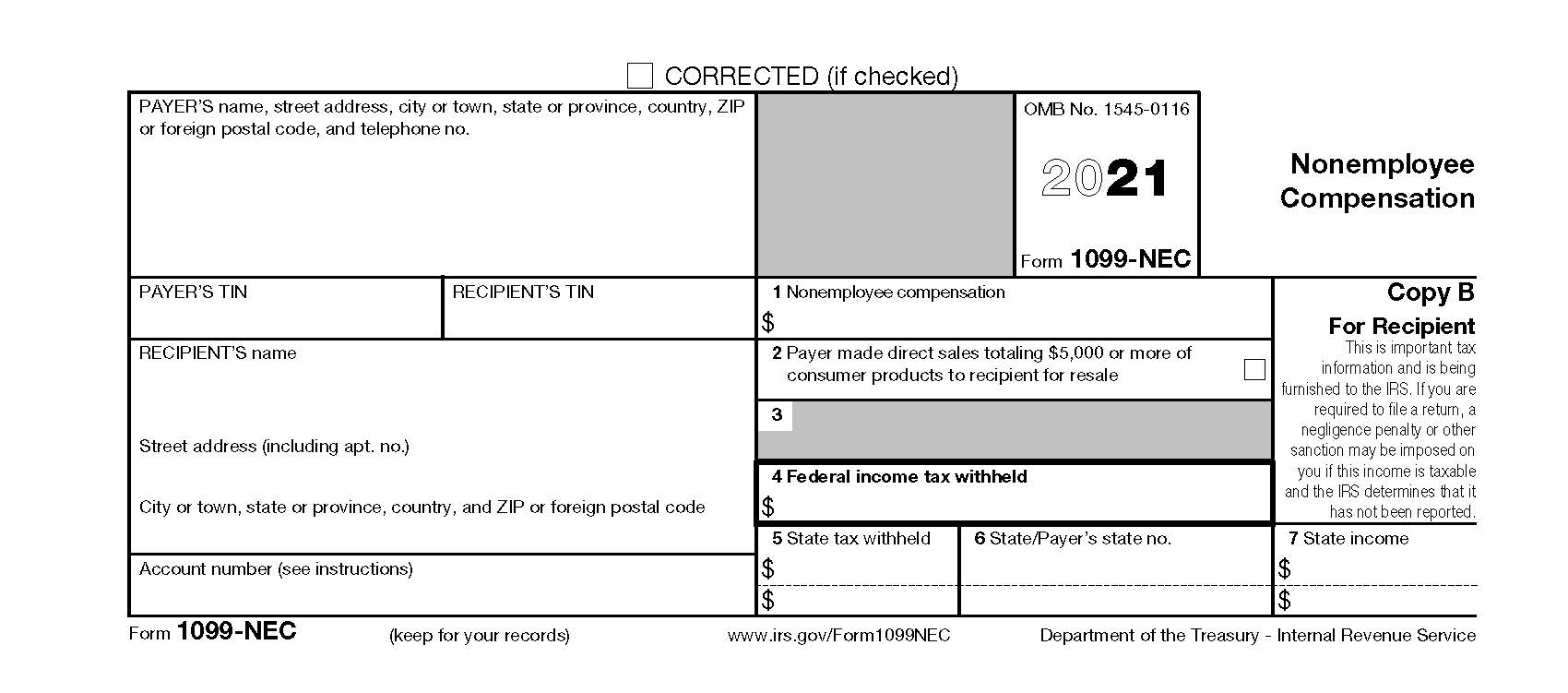

Form 1099-NEC, Nonemployee Compensation

Taxpayers must report nonemployee compensation on Form 1099-NEC beginning with the tax year 2020. This throwback form is intended to reduce confusion caused by the different filing due dates for different types of payments reported on 1099-MISCs.

Who Gets It?

Business owners must issue a 1099-NEC for payments that meet the following four conditions described by the IRS:

- Payments made to someone who is not your employee.

- Payment for services made during your trade or business activities (which include government agencies and nonprofit organizations).

- The payment made to an individual, partnership, estate, or in some cases, a corporation (generally attorney fees).

- You made payments to the payee of $600 or more.

What Is Nonemployee Compensation?

If all the conditions are met, a 1099-NEC is issued to each person you’ve paid at least $600 in nonemployee compensation (NEC) during the year. NEC Payments are defined as:

- Services performed by someone who not your employee. For example:

- Fees paid to independent contractors such as entertainers or trade people including parts and materials

- Professional service fees

- Directors Fees

- Commissions

- Referral fees

- For more examples, see the Instructions on the IRS website.

- Cash paid for fish (or aquatic life) purchased from a person engaged in the trade or business of catching fish.

- Payments to an attorney.

Excluded Payments

There is a handful of payments that do NOT get included in box 1 on Form 1099-NEC. These include:

- Expense reimbursements for nonprofit volunteers

- Deceased employee wages paid in the year after death – 1099-MiSC

- Payments more appropriately described as:

- Rent – 1099-MISC

- Royalties – 1099-MISC

- Interest – 1099-MISC

- Other Income not subject to self-employment tax – 1099-MISC

- Cost of life insurance protection or group term life insurance for former employees – W-2

- Employee wages and expense reimbursements, gifts, or bonuses – W-2

A Little Backstory

The IRS didn’t conjure this form out of thin air. The 1099-NEC was last used in 1982. Yup, 38 years ago. The form was retired in favor of the Consolidated 1099-MISC, which has been used to report everything and anything. However, the PATH (Protecting Americans from Tax Hikes) Act of 2015 confused taxpayers trying to adhere to the IRS filing due dates for the multitude of income types reported on the 1099-MISC.

While all 1099s must be mailed to taxpayers by January 31, the due date to send them off to the IRS varies. With the re-emergence of the 1099-NEC, businesses can easily separate nonemployee compensation due to the IRS on February 1, 2021. Any remaining 1099-MISCs are due to the IRS by March 31, 2021, if submitted electronically.

Caution – State Reporting May Differ

States have relied on Combined Federal/State Filing (CF/SF) forms for nonemployee compensation reporting. The CF/SF forms automatically send information filed federally to states without duplicate forms having to be filed with the state department of revenue. With the release of Pub 1220 for tax year 2020, the IRS announced that Form 1099-NEC will NOT be included in the CF/SF Program. This has left states scrambling to set up systems.

The best solution to ensure penalties are avoided for late or non-filing state compliance for NEC is to do one of the following:

- Check with your state Department of Revenue to see how they handle the new form.

- For example, Colorado’s Colorado Department of Revenue will accept submissions of Form 1099-NEC through Revenue Online.

- Use a large processing company such as Yearli who specializes in 1099 processing.

- Work with your CPA to ensure your forms are submitted timely and accurately.

Whether you are a DIYer or not, you don’t have to go it alone. We’re here to help answer your questions and point you in the right direction.

What About the Form 1099-MISC?

Don’t worry, it hasn’t gone anywhere. It also got a little update to shift boxes around to make up for moving NEC to its own form. The boxes have been renumbered, and direct sales over $5,000 will now be reported in box 7. You’ll still use Form 1099-MISC to report payments made to each person that has:

- At least $10 in royalties or payments instead of dividends or tax-exempt interest.

- At least $600 in:

- Rent

- Prizes & awards

- Other income payments

- Medical & health care payments

- Crop insurance proceeds

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

- Any fishing boat proceeds.

- At least $5,000 in direct sales of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

1099 Summary

We know this can feel a touch overwhelming. When going back through your books, the first step is to determine what payments require tax reporting. Next, decide which bucket they fit in – nonemployee compensation or something else. If you aren’t sure, reach out. We’d be happy to assist you or point you toward additional resources.

Contact us today to schedule your complimentary discovery call if you’re ready to delegate the entire process.