Can I deduct that? This is a question we hear from new and seasoned business owners alike. Being unaware of how to separate business vs. personal expenses or trying to get creative with the deductions is one of the fastest ways to get into trouble. A mid-2000 tax case against Nicolas Cage is probably one of the best examples as his incorrect filing of expenses and deductions cost him significantly.

The IRS rejected approximately 3.3 million in personal expenses for items such as limos, meals, gifts, travel, and a private jet, which Cage’s company tried to claim as business expenses. Unless documented and classified appropriately, these items represent some of the trickiest things to deduct. You could be on the hook for unpaid taxes and penalties if incorrectly deducted.

Let’s clear the air, differentiate between business and personal expenses, and dive into some finer classifications of expenses and deductions – before you mistakenly get in trouble!

Business Expenses Defined

According to the IRS, business expenses must be both ordinary and necessary. Clear. No. It’s quite murky and leaves a metric ton of room for interpretation. Thankfully, the IRS also gives us more definitions.

The IRS defines an ordinary expense as “common and accepted in your trade or business.” A necessary expense is an expense that is “helpful and appropriate for your trade or business.”

Hm. We better dive deeper. There still seems to be a large grey area to cover.

Ordinary and Necessary Expenses

While the language for ordinary and necessary appears straightforward, this is where people frequently get into trouble. This is troublesome mainly because what is ordinary and necessary in one industry is completely outlandish in another.

For example, if you operate a zoo, it would be “ordinary and necessary” to regularly purchase thousands of pounds of beef to feed the big cats. However, if you buy 300 pounds of stake each month for your computer programming practice of 3 people? That appears out of the ordinary and unnecessary, aka smells fishy.

The primary consideration is if the expense appears to be typical for your industry. That isn’t to say that you can only claim deductions that your competitors do. It’s more along the lines of an industry peer considering the cost reasonable within their business operations.

Necessary also falls into this grey area. Is it necessary to have Post-It brand sticky notes? No. Is it helpful and appropriate? Yes. Do they help you remember to send follow-up emails or that you have to a meeting at 3 pm? Then, most likely, Post-It notes help you indirectly generate revenue. Therefore they are considered a necessary expense. Whether you buy a brand name or not is irrelevant.

Expense Types

After determining something is business-related, we select how to classify the cost. We decide whether it is either the usual costs to run your business or a cost that might be required to be deducted over multiple years.

General Business Expenses

Anything related to operating your business is considered a business expense unless it falls into the Cost of Goods Sold or Capital Expenses. General business expenses are your administrative expenses, payroll, insurance, etc. We won’t bore you with a list of all the possibilities, just the ones to keep you out of trouble.

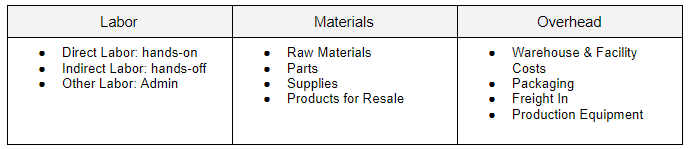

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) refers to the expenses of converting raw materials into products or purchasing products for resale.

Strictly speaking, COGS does not apply to personal service businesses, such as lawyers and doctors, unless they also sell a physical product to their clients, such as when your doctor has a supply of flu shots, and they charge for both the visit (service) and the actual shot (physical item).

The cost of Goods Sold falls into three categories: Labor, Materials, and Overhead.

One of the most significant pieces of COGS is inventory. Several valuation methods are beyond the scope of this article. We generally calculate the change between the beginning and ending inventory plus purchases to determine total COGS.

Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold

Businesses involved in manufacturing or resale benefit from professional accounting services due to the nuance of the COGS calculation. Beyond tax deductions, COGS costs are important to track separately from business operating expenses to determine product pricing and profit margins.

Capital Expenses

While these costs are titled Capital Expenses, it’s simpler to consider them investments in your business. Typically, capital expenses refer to the B-I-G purchases or at least the ones you might do a bit of research on first. Here we’re referring to three main types of costs:

- Start-up costs

- Business assets

- Improvements

Capital Expenses get capitalized and end up on the balance sheet as assets. While you cannot deduct a capitalized expense, these items are typically depreciated or amortized. The depreciation or amortization expense then becomes a general business expense over the perceived life of the asset.

Startup Costs

Many of the costs you incur investigating, licensing, and pre-operational business expenses like advertising, travel, and wages, are classified as “Start-Up Costs.” These costs are generally amortized over 180 months, which starts the business’ first month of operations.

Business Assets

The list of assets is practically endless, including equipment, furniture, land, buildings, trucks, patents, and franchise rights.

Before you freak out thinking you have to capitalize and depreciate that new $300 height adjustable desk, there’s an election you can make. The IRS updated the de minimis safe harbor election in 2016 so businesses can elect to deduct tangible asset purchases of less than $2,500 per item per invoice. So if you buy 10 of those desks, make sure the invoice shows the item’s unit cost. The de minimus safe harbor election also requires that you have a policy in place. The policy should state you will expense purchases under a certain dollar amount or with an economic useful life of fewer than 12 months.

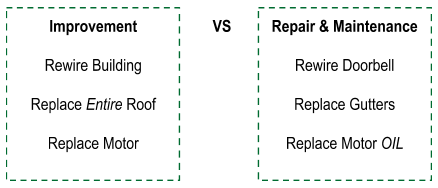

Improvements

Moving along down the tricky road of capital expenses to improvements. Improvements make something better, restore a property, or adapt the property to a new use. Where this gets tricky is improvements versus repairs and maintenance.

Repairs and maintenance are deducted as general business expenses. These are not considered to improve a piece of property, they merely keep it in working order and operating efficiently. Maintenance frequently happens on a recurring schedule.

Improvements don’t sit on your balance sheet forever. They generally end up being depreciated, and the cost is expensed over the life of the property.

Personal Expenses

At last, we come to personal expenses! I know what you’re thinking. Come on. This, at least, has to be straightforward. Well, not exactly.

Personal expenses, usually, are for things you use for yourself, a living expense, or a family expense. Things get murky again with those pesky mixed-use items that we use for our business and personal transactions. Potential trouble areas are claiming deductions such as cell phones, travel, meals, and home offices. (Just like Nicolas Cage.)

A common method to handle mixed-use property items, like your cell phone, is to estimate how much time is used between personal and business. Then document how you got to that number. You might track your car mileage; for a cell phone, you might analyze your calls and determine that 70-80% of your use is related to business.

Home offices are a subject all of their own. But generally, you use either a safe harbor method or track all the related expenses. To qualify for the home office deduction, it’s important to remember that your home office must be used regularly and exclusively for business AND be either:

- Your principal place of business;

- A place where you normally meet or deal with patients, clients, or customers; or

- A separate structure (not attached to your home) is used in connection with your trade or business.

Business vs. Personal Expenses Wrapped Up

As we’ve covered, choosing a business vs. personal expense isn’t always as straightforward as it sounds. Determining whether a cost is a business or personal expense sometimes requires a little reading.

It’s easy to see how businesses can miss out on potential deductions by erring caution and how others can end up in trouble. The first step is determining whether the cost is ordinary and necessary for YOUR business. Next, document the cost. If you’re unsure where to classify it, ask an accountant to keep yourself from accidentally getting into trouble with the IRS.

These are some of my favorite conversations to have with clients. It teaches me more about your business and allows me to tailor your tax strategy. If you have questions about your expenses, contact us, or set up a Discovery Call.