Like clockwork, as we approach the end of the year, people’s minds turn toward charitable contributions either to aid causes they’re passionate about, for the tax deduction, or both.

This year there is an opportunity for some additional win-win when donating to your favorite charitable organizations. The CARES Act changed the rules for charitable contribution tax deductions.

We’re going to highlight the changes the CARES Act made to charitable contribution regulations, go over qualifications for the deduction, and best practices to ensure you don’t get scammed this giving season.

The CARES Act – Tax Regulations Changes

Changes in tax policy are often enacted to encourage social behaviors. This is particularly true during times of hardship. Within the CARES Act signed in early 2020, there are two provisions that affect charitable giving:

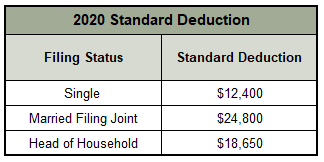

- Taxpayers who do NOT itemize deductions on Schedule A are eligible for a charitable deduction up to $300 for cash donations made to qualifying organizations in 2020.

- The limit on charitable contributions is temporarily suspended and temporarily increased on the amount of food inventory eligible for donation.

This update is an excellent opportunity for taxpayers who normally are unable to deduct their generous gifts to charity on their federal tax returns. This new “above the line” deduction means that taxpayers don’t have to have itemized deductions greater than the standard deduction to have a tax benefit from charitable donations.

The temporary limit suspension is a little more nuanced and affects big-dollar contributors. The basic interpretation is that you can donate 100% of your adjusted gross income to qualifying charities in cash. It also increases the limit for business contributions of food inventory from 15% to 25%.

There is a catch. Qualified organizations do not include donor-advised funds and private nonoperating foundations.

Charitable Contribution Deductions – The Rules

We can see a lot of incentives to donate this year if you’re in a position to do so. You’ll want to follow some basic rules to ensure that you are capturing the max tax benefit.

To Qualify for Temporary Suspension of Limits on Charitable Contribution

To take advantage of the increased charitable contribution limit, 100% of adjusted gross income, the contribution must meet the following criteria:

- A Cash Contribution.

- Donate to a Qualified Organization. Qualified organizations include nonprofit groups with religious, charitable, educational, scientific, or literary purposes.

- The easiest way to confirm an organization’s status is to go to IRS.gov/TEOS.

- Contribute during 2020. The deadline is December 31, 2020.

Organizations that do not qualify are considered to sponsor donor-advised funds or supporting organizations. This is where using the IRS’s tool comes in handy. It provides a deductibility code that identifies the type of nonprofit entity. It also provides the EIN if your tax software or accountant requests it.

Don’t fret if you’re favorite charity is a charitable fund or you’ve donated non-cash property to aid in COVID-19 or disaster relief. Your actions are still deductible. They’re just subject to the usual limitations.

Charitable Contributions Best Practices

If you’re in the giving spirit, you’ll want to follow some best practices regardless of the tax benefits.

Verify Non-Profit Status as a 501(c)(3) or Private Foundation

Unfortunately, not everyone is honest, especially in times of hardship. 2020 has been quite full of natural disasters and a pandemic. The fraudsters come out to play on our heartstrings. Before handing over your hard-earned money to that ad in your social media feed, you’ll want to verify the organization is legit.

Most charitable organizations must register with the IRS; however, certain donees, such as churches or subordinates, may not be listed. Still, the IRS’s tool (IRS.gov/TEOS) is a great place to start.

Guidestar and Charity Navigator are two wonderful sources to learn more about how efficiently your donation will be used. Both organizations provide a rating on the operations and spending of nonprofits. Charity Navigator even helps connect people with reputable organizations aligned with their interests.

Keep Records!

Record keeping is usually as simple as keeping your receipt, especially for cash contributions. If you habitually add those small $1+ donations at the checkout, you can keep a spreadsheet or journal to keep track.

For tangible donations, like household goods, you may want to record the number of items donated and how you arrived at their value.

If you donate items valued at over $500, you’ll need an appraisal. There are also additional items to consider when donating a car or stocks. IRS Publication 526 lays it all out, but it might be a good time to chat with your CPA if you’re considering high-dollar-value charitable donations.

Timing

All donations must be made by the close of your tax year. For most individual taxpayers, this is December 31.

Giving Tuesday – Let’s Give Back

As we all know, 2020 has been an unusual year. The CARES Act allows many to reap a tax benefit from giving back to their communities during hardship.

Giving Tuesday happens each year on the Tuesday following Thanksgiving. This year Giving Tuesday falls on December 1, 2020. Join us and millions worldwide in giving back to our communities in meaningful acts of kindness and compassion and supporting the causes near and dear to our hearts.

If you have questions about your charitable giving, please reach out! We’d love to connect with you.