Nothing stops your heart like seeing an IRS letter appear in your mailbox. Except seeing the bold, large print showing a balance due for penalties and interest at the top of the notice. Ouch. The fear associated with receiving one of these nastygrams runs deep. One of our most frequently asked questions from small business owners is: How do I avoid tax penalties? Today, we share how to avoid the three most common tax penalties and fines.

Penalty and Fines for Underpayment of Estimated Tax

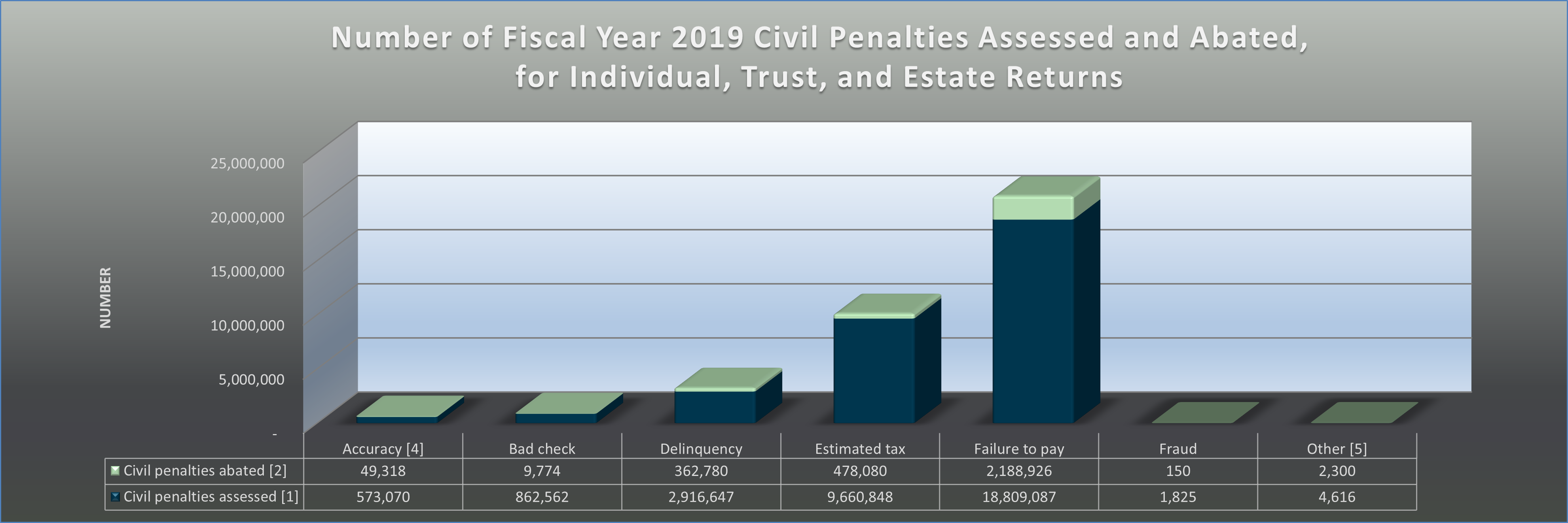

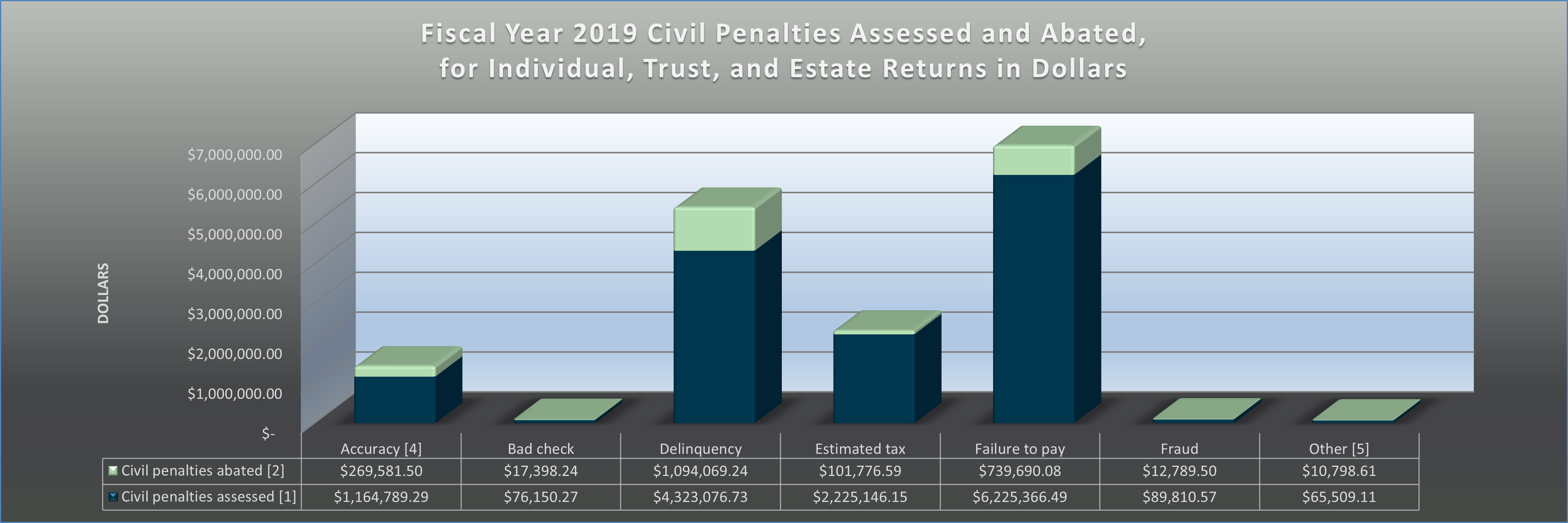

Here’s the thing, the penalty and fines for underpayment of estimated tax is one of the penalties that confuse people the most. In 2019, it accounted for about 29% of the civil penalties assessed by the IRS on individual and estate tax returns but only 16% of the total dollar value.

The reason behind the numbers is it’s a complicated penalty to calculate. Unlike our other penalties, this one has a few moving parts.

Step 1: Determine if You Owe a Penalty

This is generally the easy part. Whether you are self-employed or receive wages from an employer, if your total tax owed is greater than $1,000, you must submit timely estimated payments.

Generally, if you receive a W-2, your taxes on those wages are considered submitted on time. If you are a contractor that receives 1099 income, you generally need to submit quarterly estimates on:

- April 15

- June 15

- September 15

- January 15 of the following year

The total of all your tax estimates should be submitted under what we call the safe harbor rule. Either:

- 90% of your current year tax, OR

- 100% of your prior-year tax must cover 12 months.

Step 2: Calculate the Penalty

This is the tricky part. Technically, the IRS will do all the work for you. You can sit back and wait for them to issue you notice. If you’re more of the “I’d rather know” type, then there is lovely Form 2210. This form allows you to calculate the penalty based on your choice of three methods – the short, regular, or annualized income installment method. Thankfully, most tax software (probably all) will do this calculation for you.

You can reduce or eliminate the penalty by Filing Form 2210 if any of the following situations apply:

- You made quarterly estimates based on tax planning.

- You show large income in a late quarter (i.e., your sales all occurred after Black Friday.)

- You changed filing status (i.e., you got married or are now filing single.)

- You had an overpayment applied from the prior year.

- You’re a farmer or fisherman.

- A casualty or disaster occurred, making it unfair to impose a penalty.

- You’re retired or disabled and have reasonable cause.

One of the best ways for employees to avoid underpayment penalties or fines is to double-check their W-4 and update each year for status changes. Investing in tax planning is a fantastic idea for the self-employed especially once your income starts steadily.

Failure-to-File Penalty

Next up, the failure-to-file penalty was the least common penalty assessed for Fiscal Year 2019, according to the IRS Data Book. This penalty is assessed by the IRS when a return is filed late. A return is considered late if you file after the due date without filing an extension.

This fine can accumulate quickly. Impressively cost-prohibitive, the penalty is 5% EACH month you have tax due, up to a maximum of 25%. There’s also a minimum penalty if your return is over 60 days late. This minimum is adjusted each year for inflation. In 2020, the minimum penalty was the lesser of $435 or 100% of the tax owed, in addition to the monthly interest percentage.

However, the IRS may remove (abate) the penalty if you can prove you had reasonable cause. This is notoriously difficult to prove. Documentation of a fire, natural disaster, or doctor’s note stating you or an immediate family member was incapacitated is required.

This penalty is the simplest to avoid. Even if you cannot pay the tax on time, you should file an extension or return. Doing so will prevent penalties and interest from accumulating while you sort out payment arrangements.

Failure-to-Pay Penalty

So closely linked to failure-to-file that they’re listed on the same IRS page, the failure-to-pay penalty is the most common penalty assessed by the IRS. The exact name says it all. This penalty is imposed on any unpaid taxes after the ORIGINAL due date. Many people don’t realize that their extension to file is not an extension to pay. Taxes for individuals are due to be paid by April 15.

But wait, I extended it and don’t know my tax bill yet?! Paying in the safe harbor amount of 100% of the prior year’s tax prevents this penalty from being assessed while the exact tax is calculated.

While the fine doesn’t increase as fast as failure-to-file, it can also pack a punch over time. The failure-to-pay penalty increases by one-half a percent (0.5%) each month up to 25% on the outstanding tax due. If you receive an extra nasty gram from the IRS intending to levy property, the rate goes up to 1% if still unpaid after ten days.

You can reduce the impact of this penalty by entering into an installment agreement with the IRS. The penalty rate decreases to one-quarter of a percent (0.25%) for any month the installment agreement is in effect.

The best way to avoid this penalty is to make estimated payments and engage in tax planning. Making your April 15 bill is manageable. If that is not an option and your bill is an unpleasant tax day surprise, entering into an installment agreement helps prevent the penalty from becoming massive.

Other Penalties

There are a handful of other penalties that the IRS might charge. These are relatively less common or might be calculated on the return. They include:

- Dishonored check: If your payment is rejected, the IRS will issue a penalty of 2% for payments over $1,250 or the lesser of $25 or the total tax due if the check is under $1,250.

- Retirement-related: Some early withdrawals from retirement accounts result in a penalty. This is generally calculated on the tax return and is something you’ve most likely discussed with your financial and tax advisors ahead of time.

- Penalty for filing a frivolous tax return: It’s $5,000 if you want to tell the IRS you don’t believe in taxes. Or if you’re withholding the portion of your taxes paid for services of the Federal budget you disagree agree with. (There are few other specified frivolous arguments.)

- Accuracy penalty/Negligence: Large errors (greater than 20%) could result in an additional penalty for “substantial understatement” or “negligence or disregard of the rules or regulations.” This generally occurs if when a W2 or large 1099 is deliberately left off the return.

While uncommon, these penalties are still costly. They can generally be avoided with good documentation and tax planning.

Penalty Summary

So there we have it, the significant penalties and fines, why you might be issued a notice for a penalty, and how you can avoid them. The best way to avoid penalties is to participate in tax planning. It allows you to prepare for changes in your circumstances in real time, heading off any problems before you get a dreadful IRS envelope.

The biggest thing to remember if you see that IRS envelope and notice: breathe. We’re here to help. Many penalties can be reduced or resolved with phone calls, looking through your tax records, and letters documenting the facts and circumstances.

If you’ve received a notice and would like help resolving it, give us a call or contact us here. You don’t have to go it alone.