Are you prepared to lose 5% of your annual revenue to fraud? That’s the amount Certified Fraud Examiners (CFEs) estimate is annually lost in the 2020 Report to the Nations issued by the Association of Certified Fraud Examiners (ACFE). Every few years, the ACFE gathers data on occupational fraud, its cost, and its effects on small businesses. Here is what occupational fraud is, the impact it has and the ways we recommend preventing fraud in your business.

What Is Occupational Fraud?

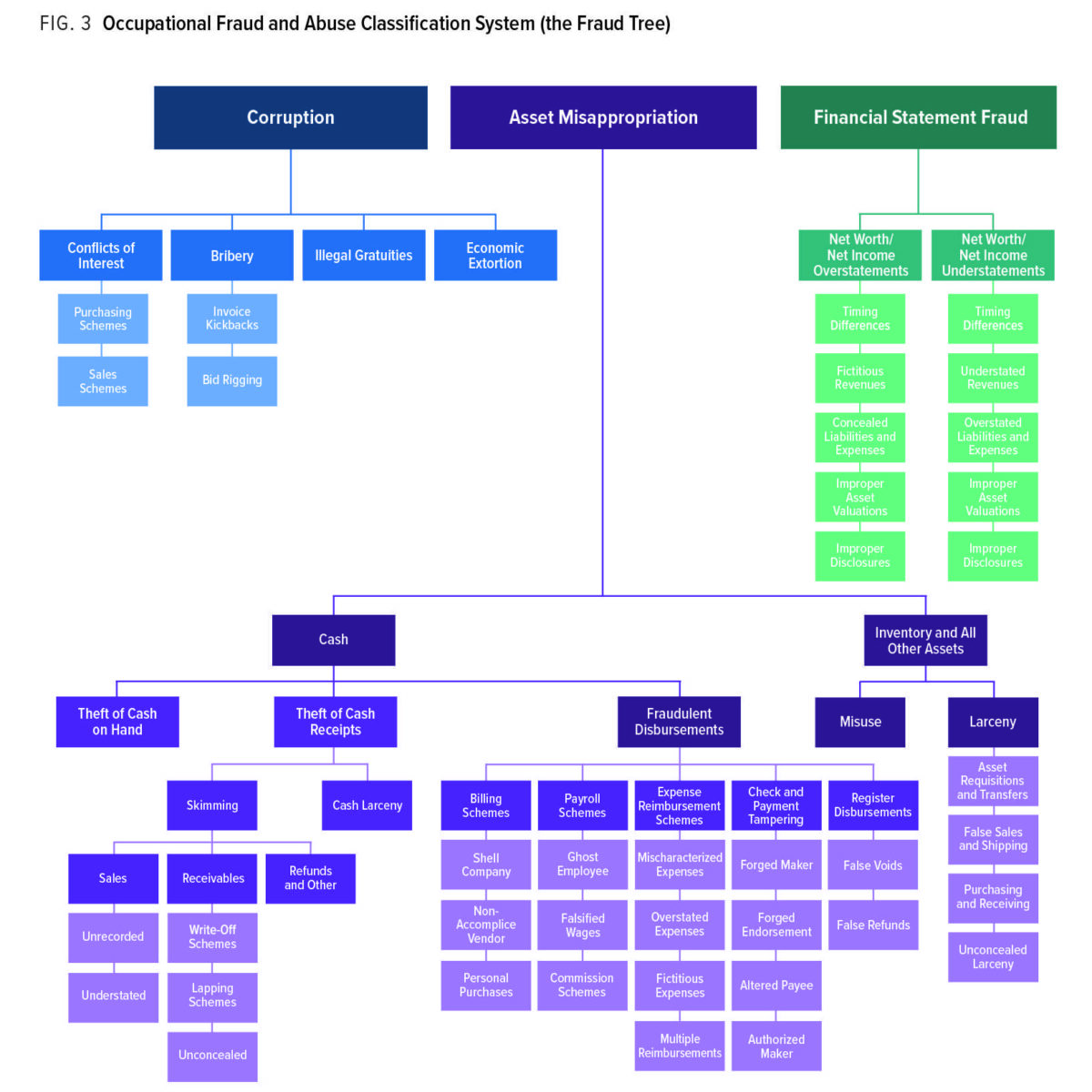

Since the first Report to the Nations in 1996, the ACFE has noted occupational fraud involves multiple schemes; it is a tree with three main branches – asset misappropriation, corruption, and financial statement fraud.

Asset misappropriation schemes in which employees steal or misuse their employer’s resources is the most common type of occupational fraud. It accounts for 86% of the employee fraud observed in the 2020 Report to the Nations. Asset misappropriation has the lowest median loss of $100,000. While less common at 10% of cases observed, financial statement fraud is the most costly to organizations at almost a cool million.

Numbers like those above are fine for the shock and awe portion of fraud reporting, but what do the occupational fraud classifications mean in laymen’s terms? Thankfully, the ACFE has a plethora of charts and diagrams included in their reports and for educational use. Occupational fraud’s classification breaks down in a Fraud Tree. This handy dandy flow chart, shown below, breaks down the categories of asset misappropriation, corruption, and financial statement schemes into theories that are slightly less abstract and simpler to identify.

(Note the Full report has a glossary of these terms on page 86)

How Does Occupational Fraud Affect Small Businesses?

As a small business owner, you might be thinking to yourself: Fraud isn’t my problem. Fraud is only a problem for the big boys like Amazon. Like Amazon recently saw in its fraud case involving four individuals who attempted to defraud Amazon of $19 million by targeting their invoicing system.

Don’t be fooled.

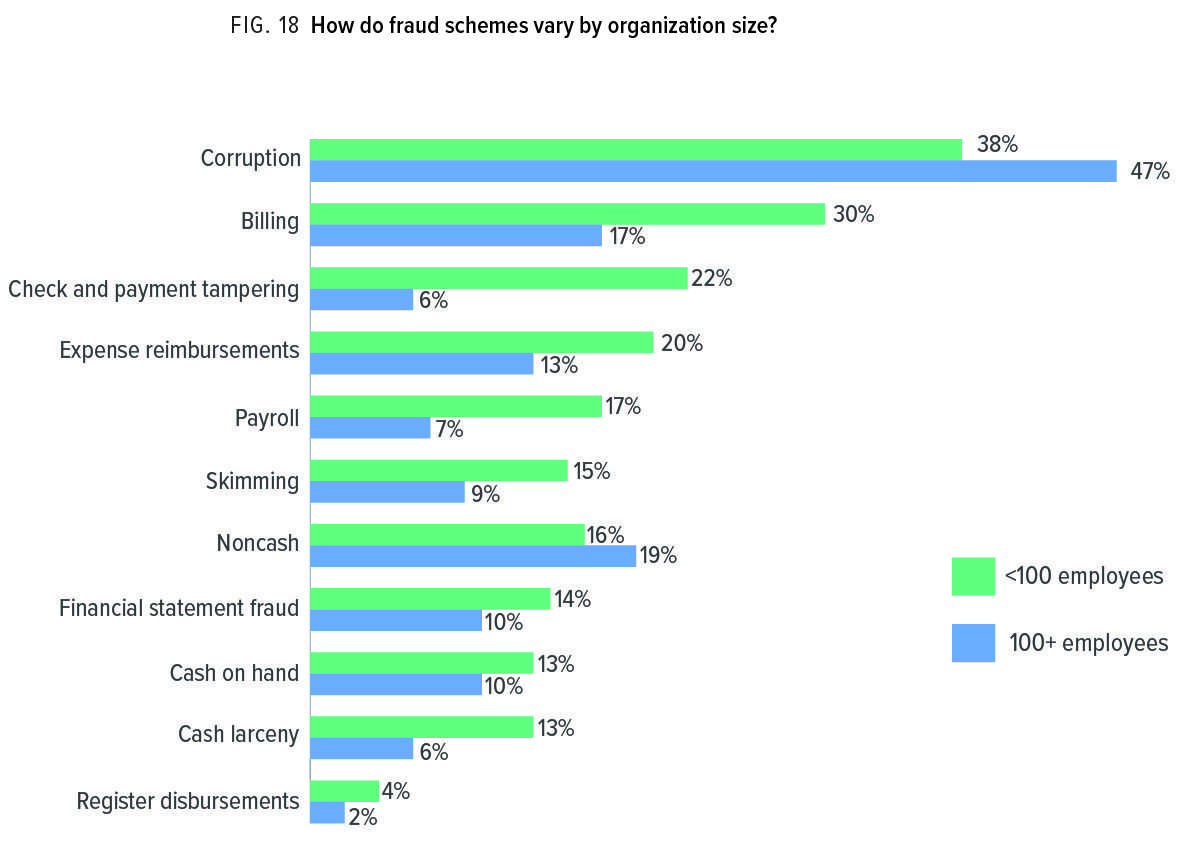

While occupational fraud hits all companies at about the same rate (approximately 23% – 27%), companies with less than 100 employees have a median loss of $150,000, which is $30,000 MORE than organizations with 100-999 employees.

The Global Survey on Fraud also showed that some asset misappropriation fraud schemes were more likely to occur within small businesses than in large companies with over 100 employees. For example, small businesses experience billing schemes at almost a two times higher rate (30% vs. 17%). Check and payment tampering happened at nearly FOUR times the rate of large companies (22% vs. 6%).

Large organizations don’t always get off ahead. Corruption and noncash scheming occurred more frequently at large organizations.

How do we Prevent Occupational Fraud?

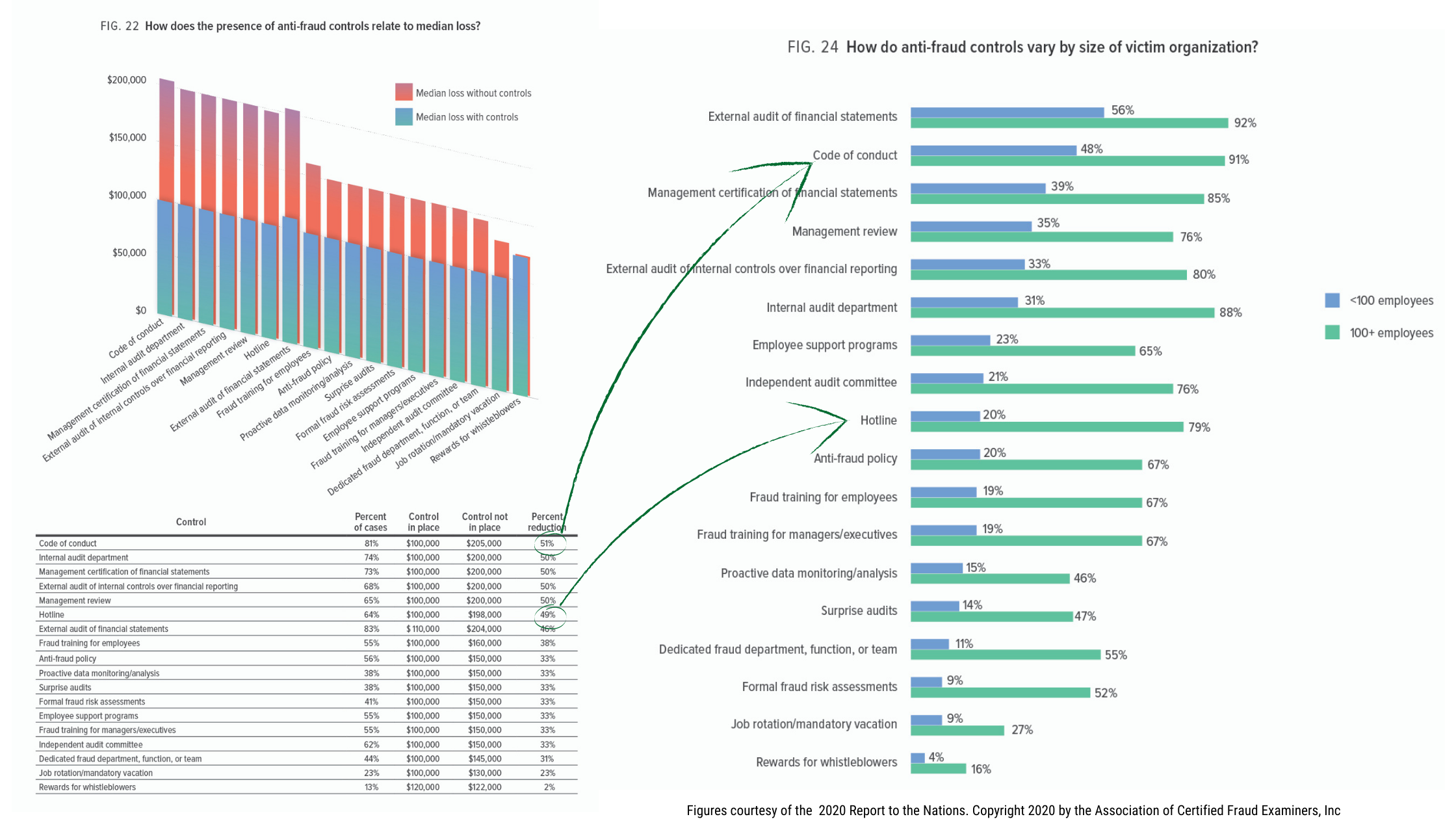

This is the billion (yes, with a B) question. The key findings show that 3.6 billion was estimated to be lost worldwide due to occupation fraud. Analysis of the controls in place at the time of the fraud scheme shows some actions reduce risk AND reduce the median monetary loss when in place. Once again, the ACFE has provided fantastic graphics that sums up this information.

The key findings tell us that CFEs discovered 43% of schemes because of tips. Organizations that provide Fraud Awareness Training for employees were 19% more likely to gather tips through formal reporting mechanisms, i.e., an ethics or fraud hotline via telephone or email.

Breaking down the data on Internal Controls

The tiny print aside, many available anti-fraud controls significantly reduce the median fraud loss. What truly stands out from the figures above is that two of the most cost-efficient fraud prevention controls for a small business owner to implement may also reduce the median loss by approximately 50 percent.

When we look at the figures, we see that no internal control eliminates internal fraud. While 81% of the cases examined still experienced fraud loss with a code of conduct in place, those businesses with this internal control had a 51% reduction in the overall median loss. That’s a big deal. That small internal control of a code of conduct could reduce the loss from $205,000 to $100,000. Yet, when we look at the percentage of small businesses with a code of conduct in place, only 48% of small companies have this low-cost, effective, anti-fraud internal control.

Next, we look at the most effective tool for discovering fraud, hotlines. This simple-to-enact and relatively low-cost internal control for small businesses reduces the median loss by 49%.

Again. That’s a significant risk cost reduction. We’re talking about lowing the potential loss from $198,000 to $100,000. But. Only 20% of small businesses, 1 in 5, are taking advantage of this low-cost fraud discovery tool, decreasing potential losses.

Lessons Learned

Occupational fraud cases cover a wide range of schemes. From corruption to larceny to skimming the books, anything an employee or owner can touch or influence can also present an opportunity for fraud. The Association of Certified Fraud Examiners has classified these various schemes into three main classifications to aid in fraud detection.

While we’d like to believe that smaller organizations have a “family” atmosphere where people are more trustworthy and honest, case studies show this isn’t always the case. Asset misappropriation schemes involving resource fraud, i.e., billing, cash theft, etc, occur at higher rates due to fewer internal controls.

There is hope! Fraud prevention and internal controls are not just for large organizations with over 100 employees and huge budgets. Two low-cost and risk-reducing fraud controls to reduce occupational fraud schemes are implementing a code of conduct and putting a hotline in place to report fraud, waste, and abuse. These relatively simple actions could save your business thousands of dollars over the life of your business.

The full report with all the insights, key findings, charts, and glossary of terms is available through the ACFE free of charge.

Please reach out with any questions. We love assisting our clients with expanding their knowledge and speaking with you about all aspects of your business.