Whenever we take on new clients, one of the first things we want to discover is where they are in the business life cycle — knowing where they are in their business journey allows us to help them achieve their goals.

So what is the business life cycle? Well, just like people, a business goes through stages of life.

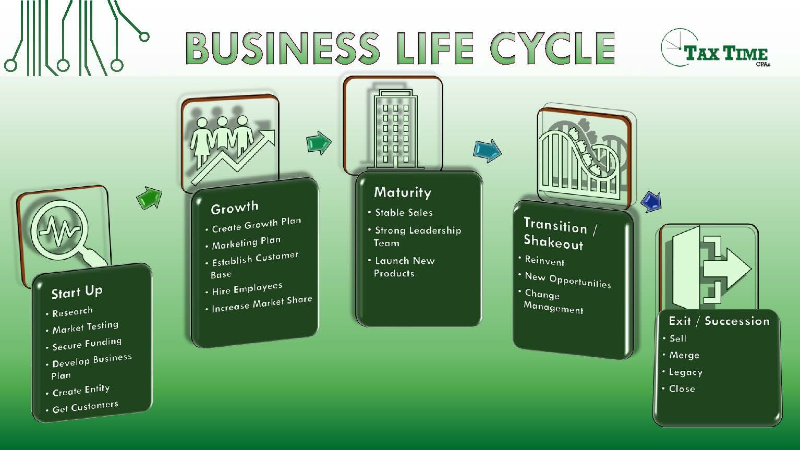

Most business analysts agree that the business life cycle has four stages: startup, growth, maturity, and transition before completing the journey with an exit.

We will walk through the stages, so you can WOW your CPA at your next financial planning meeting.

Startup Stage

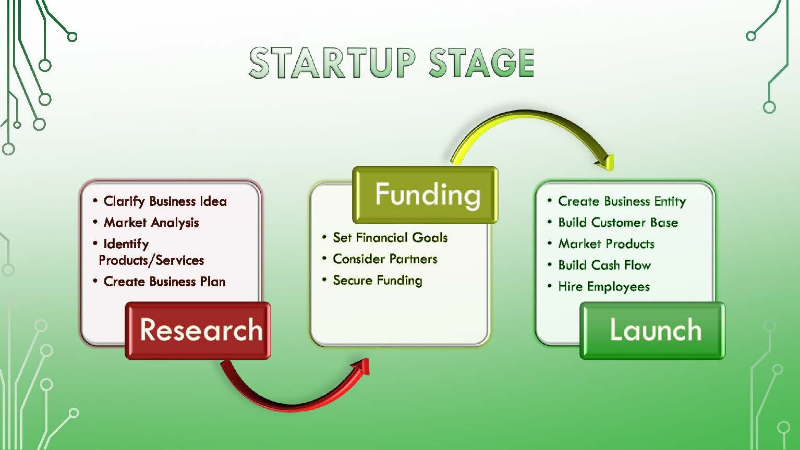

In the startup stage, it feels like the most steps. Before launching, you spend time clarifying what you want to do. Once you understand that, market research lets you discover your potential competitors. Depending on the type of business you’re starting, you might even consider bringing in partners to help with resources and fill gaps in your skillset.

It’s also in this stage that you are setting financial goals. Setting financial metrics helps you discover if you need to secure funding to get off the ground. If you need outside funding, you’re also targeting potential investors to get your dream moving. Many call this the bootstrapping phase because startups often focus on the services they need. Lean startups avoid all the bells and whistles of fancier technology and services.

In between funding and launching, you may decide to hire employees. The timing usually depends on the type of business and industry standards. For example, if you’re starting a restaurant, you need employees immediately. If you’re starting a solo consulting practice, hiring help may not occur until you’re in the growth stage.

Once you’ve launched, you’re considered a startup until you start to scale. Your primary startup activities include choosing and creating your business entity, building your customer base, and developing a marketing plan for your primary products. As you get to work on your primary activities, you begin to create your cash flow. Once you have a steady cash flow, the startup mindset starts to move toward growth.

Growth Stage

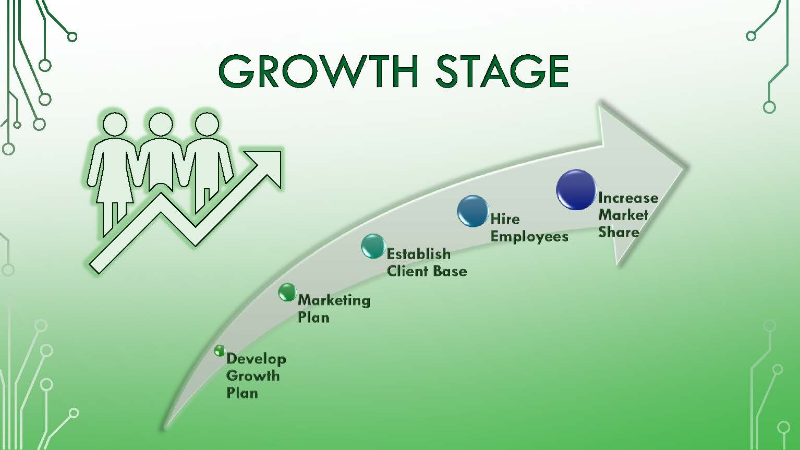

Here’s where the fun begins! Once your business has hit a few sales targets, things start to fall into place. Here the company is creating a constant flow of income, and customers are rolling in.

You focus on establishing and maintaining your customer base within your growth plan. Your customers have come to know what to expect from you, and you can capitalize on that experience to create a marketing plan. You’re also able to focus on growing your sales and operations. A focused growth and marketing plan can help your business capture increased market share.

When in growth mode, many small businesses consider hiring staff or outsourcing administrative tasks and other day-to-day functions of the company. During the startup stage, owners frequently wear “all the hats” and have to do everything themselves. Once the business hits its stride, the owner can delegate some of the day-to-day stuff and focus on growing it.

Maturity Stage

Phew. You did it. Your business has taken off and has hit a place of stable, consistent profits. At this point in the business life cycle, many business owners enjoy the benefits of a regular salary rather than putting their money back into operations.

While it might feel like the time to kick back and enjoy the ride, the maturity stage has its risks. Profits are stable, but growth is nominal. Here, you want to invest in an excellent leadership team to ensure your business endures for years. Challenges faced by mature businesses are new competition and becoming stagnant. It’s a fantastic time to explore new products.

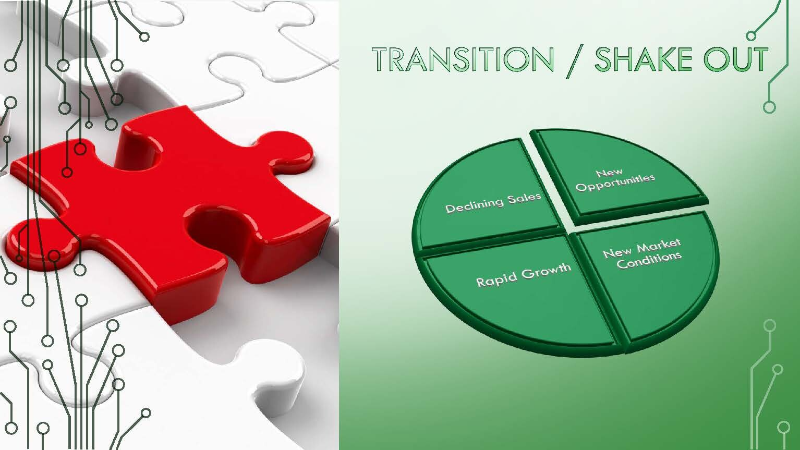

Transition / The ShakeOut Stage

There is some disagreement on the timing of the transition stage. Some say it happens before maturity, others after. Also referred to by some as the shakeout stage, this is when the business experiences some disruption. There are numerous good and bad things that could cause a transition cycle.

The best approach to transitional phases is to develop change management strategies ahead of time. Things that can disrupt current operations and require a change management strategy are:

- Declining Sales: Is this due to changes in consumer trends or an internal issue?

- Rapid Growth: Are you ready?!

- New Market Conditions: Hello, 2020. How will you adapt to changes in the way businesses are regulated?

- New Opportunities: To be honest, all of the above could be an opportunity to improve your business.

The key to transition is your response. When managed appropriately, successful companies seize new opportunities, and the business can continue to grow.

Exit / Succession Stage

Not to be ignored is the final stage of every business. Small business owners often overlook planning for the exit or succession stage until it’s staring them in the face. Business coaches recommend entering the business startup stage, and knowing how you want to exit your business.

There are four main ways to exit your business:

- Sale: After determining the value of your business, you can sell to an interested party.

- Merge: If you no longer want to go it alone or if you’d like to take advantage of the skills of another organization, mergers are common practice among small and large businesses.

- Legacy: You can pass the business to a family member, friend, or trusted employee and retain an ownership percentage to benefit from income from the company. This allows you to step back from daily operations and potentially receive revenue from the business.

- Close: You can dissolve and close your business forever. This option is usually used when the company is no longer profitable or for personal reasons.

Whichever route you’re considering, you should always consult with a business advisor to discuss each option’s legal and tax consequences before signing documents.

Business Life Cycle Recap

Well, there we have it. Next time you meet with a financial planner or accountant, you’ll know where your business is in the business life cycle. These stages are cycles. So you may move from growth to maturity and back to growth after a transition stage. While many images online show the life cycle as a pretty bell-shaped chart, how your business gets from startup to exit might be more of a winding road.

We’d love to be part of your journey. If you need help with the next steps or evaluating your financial plan, we’re here to help! To meet with us about where your business is in its life cycle and how strategic tax planning could help your business contact us or schedule a Discovery Call.

If you found this article helpful, please share it with your friends!

Author: Colleen Kern, CPA, CFE