Ah, credentials. Enrolled Agent (EA). Certified Public Accountant (CPA). Certifications require time and effort but result in coveted letters at the end of a professional title. But to those outside of the industry, they mean little beyond… Uh ya… You must be qualified to do… well, something?

You often see E.A. and CPA after people’s names in the tax arena, but what do they mean? Choosing an Enrolled Agent (EA) and Certified Public Accountant (CPA) depends on your needs. One is not necessarily better than the other.

The answer, like all accounting questions, is it depends.

Enrolled Agent (EA)

An Enrolled Agent earns the privilege of representing taxpayers before the Internal Revenue Service. While a formal education isn’t required, aspiring E.A.s complete educational requirements before they start the job.

First, they must obtain a PTIN (Preparer Tax Identification Number). The IRS established this unique number to help identify paid tax return preparers without exposing the preparer’s social security number. It is required for anyone that professionally prepares or assists in filing federal tax returns.

After obtaining a PTIN, an E.A. must undergo a Special Enrollment Examination (SEE). The Candidate Bulletin highlights what candidates can expect from each of the three parts of this exam. The three parts contain 100 multiple-choice questions on the following topics (for 2020):

Special Enrollment Examination

- SEE1: Part 1 — Individuals

- Preliminary Work with Taxpayer Data – 17 questions

- Income and Assets – 21 questions

- Deductions and Credits – 21 questions

- Taxation and Advice – 14 questions

- Specialized Returns for Individuals – 12 questions

- SEE2: Part 2 — Businesses

- Business Entities – 28 questions

- Business Financial Information – 39 questions

- Specialized Returns and Taxpayers – 18 questions

- SEE3: Part 3 — Representation, Practices and Procedures

- Practices and Procedures – 25 questions

- Representation before the IRS – 24 questions

- Specific Types of Representation – 19 questions

- Completion of the Filing Process – 17 questions

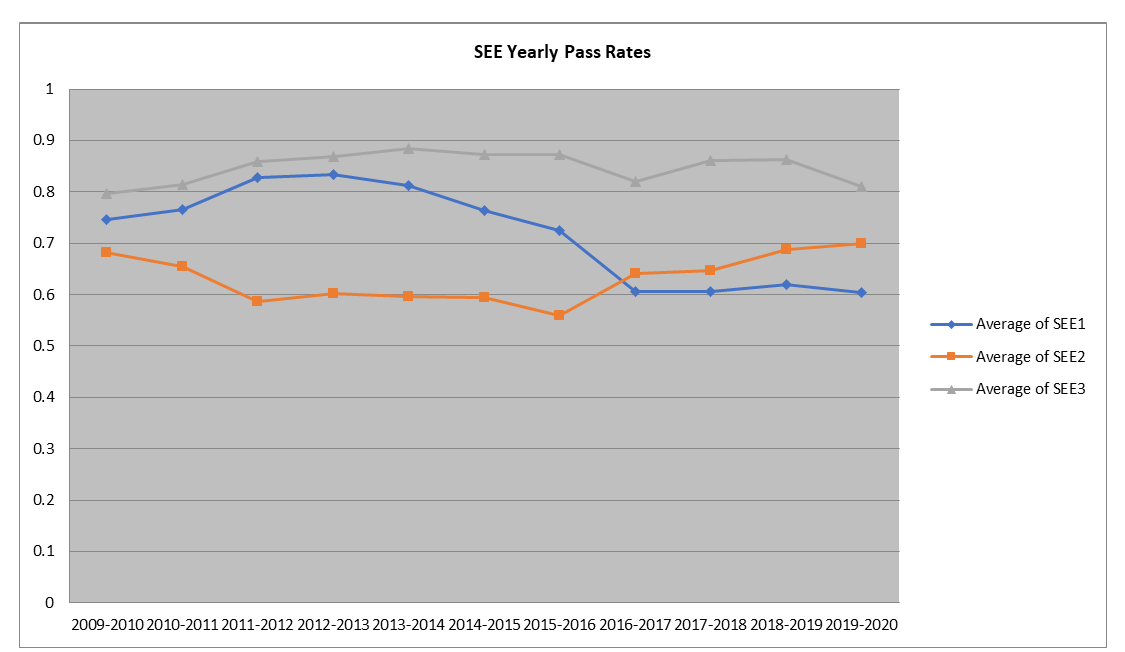

The Candidate Bulletin outlines subsections and topics for each part. Candidates get 3.5 hours for each section, taken in any order and scheduled during the testing window from May 1 until February 28. Since the test is scored immediately, test takers know what to expect upon completion. If they fail, they must wait 24 hours to retake the exam. A test taker can try up to four times for EACH exam from June to February. The pass rate for each section varies but is in the 60%-80% range.

Once passed, candidates apply for enrollment, pay the fee, and pass a suitability check. The suitability check determines if tax compliances are current, tax liabilities are paid, and the criminal backgrounds check out.

Tada! Enrolled Agent!

Certified Public Accountant (CPA)

The Certified Public Accountant credential can be defined as:

A CPA is an accountant who has satisfied the educational, experience, and examination requirements of their jurisdiction necessary to be certified as a public accountant. CPAs audit financial statements of both publicly and privately held companies. They serve as consultants in many areas, including tax, accounting, and financial planning.

The CPA Licensing Process

CPAs are required to obtain an education. Candidates need 150 credit hours of accounting education and business management to qualify for licensure. That is before they sit for the exam. The specific breakdown varies by jurisdiction. However, 24 credits of accounting and 24 credits of business administration are generally required. (14 states allow less than 24 credits of business.)

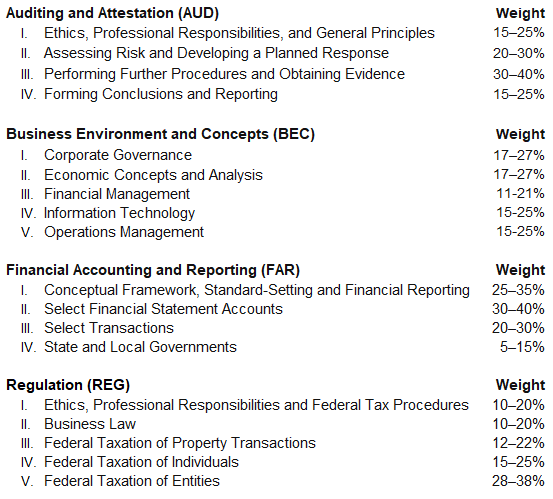

Once education is completed, it’s time to apply for the exam. The Uniform CPA Examination is conducted in any U.S. jurisdiction. Candidates typically apply under the rules where they live. Due to the CPA exam standardization, candidates schedule to take the exam in any jurisdiction. It consists of four sections with each divided into five testlets. These testlets consist of multiple-choice questions (MCQ), task-based- simulations (TBS), and written communication tasks (WCT). The sections break down as follows:

Test Results

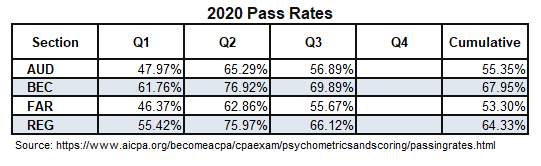

Unlike the scaled scoring of the SEE, the CPA exam is weighted. Candidates must wait up to two weeks to determine their score. There is also a lower pass rate for the CPA Exam. In 2020, the pass rate for each section ranged from about 53% – 68%.

Candidates have four hours to complete each section and only 18 months to complete all four areas. The four testing windows run January 1–March 10, April 1–June 10, and July 1–Sept. Ten and October 1–December 10. While all exam parts are scheduled in the same testing window, a failed section cannot be retaken in the same window. This pressures candidates to ensure they are adequately prepared for all areas so they don’t need to unnecessarily pay for the exam sections.

Continued Requirements and Exams

After CPAs pass the exam requirements, they must obtain a certain level of time and experience before operating independently. To protect the public’s interest, jurisdictions require candidates to practice under the supervision of a licensed CPA for one to three years.

More information on the exam content and the licensing rules for each jurisdiction can be found on the AICPA (American Institute of CPAs) and NASBA (National Association of State Boards of Accountancy) websites. The AICPA even has a handy “This Way to CPA” informational roadmap website to help interested parties learn more about each state’s licensure requirement.

Continuing Professional Education (CPE)

Whether a tax professional gains their E.A. or CPA credential, both certifications require advanced knowledge of the laws and regulations in their respective fields.

Enrolled Agents undergo 72 hours of continuing education for each 3-year cycle they’ve been registered. The process is based on the last number of their social security number. E.A.s cannot lump 72 hours in one year. They must complete at least 16 hours yearly and a 2-hour ethics requirement yearly. The IRS must approve CPE providers.

CPAs have a similar requirement. While the CPA’s ruling jurisdiction determines the specific allocations by year. Most states require approximately 40 hours yearly, with an ethics requirement of around 2 hours. For example, Colorado’s CPE requirement is 80 hours over a biennial period ending on odd years with a 4-hour ethics requirement.

Enrolled Agents

When choosing a credential, it helps to look at what each is designed to do. Enrolled Agents have a niche. They study the tax code carefully. E.A.s prepare tax compliance and represent taxpayers in disputes before the IRS the same way a tax attorney could.

Certified Professional Accountants

Certified Professional Accountants spend additional time beyond the world of tax and focus on multiple facets of accounting and business management. They must understand operations, business law, information technology, and economic concepts. CPAs learn to examine a company’s financial health, not just the tax effect. This is also the only certification to issue an audited opinion on financial statements.

What is a CPA?

CPAs are employed in public and professional service firms, small businesses and industries, government, and education. They oversee and deploy a wide range of business services, including tax, auditing, accounting and financial reporting, and managing internal controls, to name a few.

As the saying goes, all CPAs are accountants; not all accountants are CPAs.

So Who Should You Choose?

It’s hard to choose one over the other. It depends on the services you need. An Enrolled Agent will meet your needs if you need a one-and-done tax service. Their experience determines the extent of services offered.

To get a robust tax plan that includes your complete financial picture, choose a CPA. They examine your business and finances, consider your short and long-term goals, and optimize tax-saving and wealth-building strategies. Choose a well-rounded professional to incorporate budgets, cash flow analysis, and other accounting services.

Learn about our holistic approach. Read more in our article: A Holistic Approach to Accounting.