Establishing a family LLC is not new, but it is gaining speed as high-income earners seek ways to protect their hard-earned assets and develop generational wealth. Baby boomers have the highest...

Establishing a family LLC is not new, but it is gaining speed as high-income earners seek ways to protect their hard-earned assets and develop generational wealth. Baby boomers have the highest...

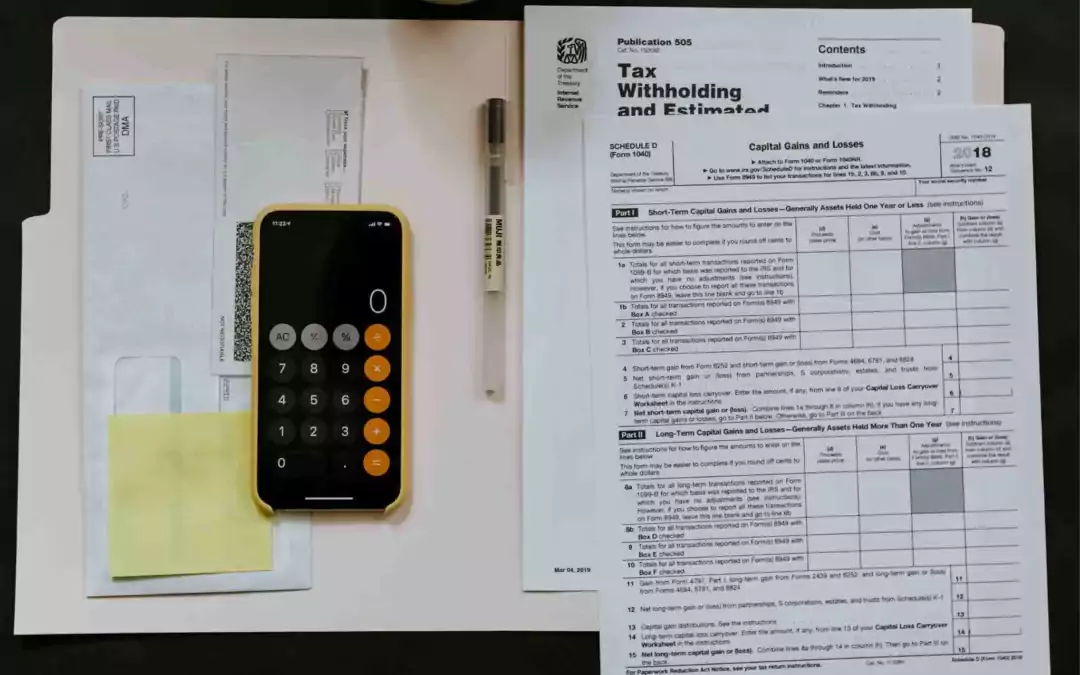

Last month, the U.S. Supreme Court unanimously favored the IRS in the court ruling, Polselli v. Internal Revenue Service, permitting the agency to request the financial records of delinquent...

Small business owners have received an unexpected shock this tax season, with many owing more than expected. As the nation emerges from Covid-19, some businesses have experienced higher revenues...

If I had a penny for every time a small business client asked me one of the questions below, I might not be a CPA anymore. Whether they run a taco stand in downtown Denver or an oil and gas business...

Cybersecurity issues are a modern-day way of life. Threats to our personal data and information occur daily as hackers and ill-spirited actors work to steal information they can financially...

Inflation impacts everything - the cost of goods, services, utilities and even taxes. In 2023, the IRS adjusted some 2023 tax guidelines to lessen the chance of earned income bracket creep. Bracket...

Many Homeowners Associations get confused when filing their annual taxes. Inexperienced board members need help understanding which tax reports to file, how to complete Form 1120 and if their HOA...

Most people starting a small business default to filing a sole proprietorship. Why not, it is generally quite easy to do. But, other entity structures may work better to accomplish your financial...

Taxes and death are the only two guarantees of life. While you cannot avoid death, you can reduce or avoid some tax liability. If you want to reduce your taxable income, credits, deductions and...

When you own a small business, tax deductions can lighten your tax burden and save you money. They make the cost of doing business more affordable. The more you understand deductions, the more you...